Navigating Tax and Accounting Challenges with Advanced Solutions

In the complex world of tax and accounting, understanding the mess of regulatory compliance while ensuring workflow efficiency poses a significant challenge for professionals.

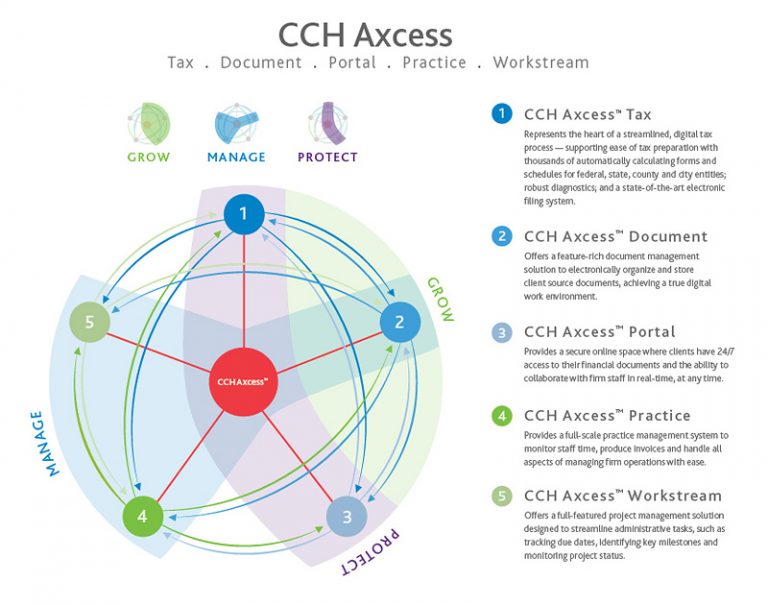

Wolters Kluwer’s suite of CCH products offer comprehensive solutions that address these complex demands with accuracy and ease.

In this blog post, Creative Networks is determined to answer all your questions related to CCH.

Exploring the Wolters Kluwer CCH Product Suite

Wolters Kluwer’s CCH products involve a broad range of tax and accounting solutions, each designed with specific industry needs.

From tax preparation and compliance software to audit management and financial reporting tools, these products integrate innovative technology with deep regulatory vision, providing a vigorous foundation for professionals in this field.

Key Features of CCH Products Enhancing Compliance and Efficiency

- Up-to-date Information: CCH products are unique for their commitment to real-time regulatory updates. This feature ensures that tax and accounting professionals always work with the latest tax laws and accounting standards, implanting compliance in their workflow.

- Integrated Research Tools: The integrated research capabilities within CCH products allow users to delve into authoritative sources for answers to complex questions, streamlining the research process and embedding it flawlessly into their workflow.

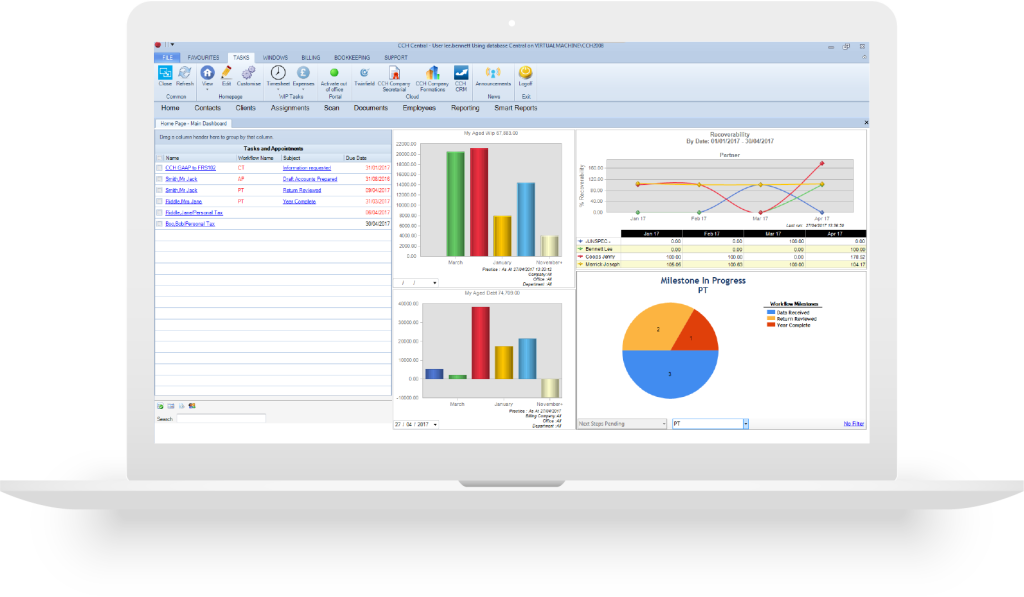

- Automated Workflow Solutions: Automation is at the core of CCH products, designed to streamline repetitive tasks, minimise manual errors, and free up valuable time for more strategic work.

- Cloud-Based Accessibility: The cloud-based architecture of many CCH solutions offers unmatched flexibility, allowing professionals to access critical data and tools from anywhere, facilitating collaboration and adapting to the modern remote work environment.

Maximising the Benefits of CCH Products: User Tips

To fully take advantage of the capabilities of Wolters Kluwer’s CCH products and ensure they are driving both compliance and efficiency within your tax and accounting workflows, consider the following comprehensive tips and strategies:

1. Engage with Training and Support Resources

Wolters Kluwer provides a wide range of training materials, tutorials, and support resources for CCH products. Take advantage of these resources to deepen your understanding of the software’s features and functionalities. Regular participation in webinars, online courses, and live training sessions can significantly enhance your proficiency and ensure you’re using the software to its fullest potential.

2. Understanding Your Workflow

Begin by analysing your current workflow to identify specific tasks, processes, and areas where CCH products could be integrated or optimised. Consider the types of tax returns you file, the accounting tasks you perform regularly, and any repetitive processes that could benefit from automation.

3. Setting Up Custom Templates

CCH products often allow for the creation of custom templates, which can save significant time and ensure consistency across similar tasks. For example:

- Tax Templates: Create templates for different types of tax returns you regularly file, pre-populating them with common information and schedules.

- Report Templates: Design report templates that align with your firm’s or clients’ formatting preferences, including branded elements, specific financial metrics, and analysis sections.

To create a custom template, navigate to the template settings within your CCH product. Choose the type of template you’d like to create (e.g., tax, report, invoice) and use the template editor to add, remove, or modify fields, sections, and formatting to match your requirements.

4. Tailoring Report Formats

Customising report formats ensures that the output from CCH products directly meets your needs or those of your clients, reducing the need for manual adjustments. This can include:

- Financial Reports: Adjust the layout and content of financial statements, balance sheets, and other reports to highlight the most relevant information for your practise or clients.

- Compliance Reports: Customise compliance reports to focus on the key areas relevant to your industry or the specific regulatory requirements you’re addressing.

In the report settings, select the report type you wish to customise. Use the report designer to adjust the structure, add or remove data fields, and apply formatting styles that meet your presentation standards.

5. Regularly Reviewing and Updating Settings

Schedule periodic cheque-ins to reassess your workflow, evaluate the effectiveness of your custom templates and reports, and update your notification preferences to reflect any changes in your practise or regulatory environment.

By taking the time to customise CCH products to your specific workflow, you can significantly enhance your productivity, ensure greater compliance accuracy, and provide more value to your clients.

6. Stay Informed About Updates and New Features

The tax and accounting landscape is constantly evolving, and so are CCH products.

Wolters Kluwer frequently updates its software to reflect the latest tax laws, regulations, and best practises.

Keep an eye on product release notes, subscribe to update notifications, and regularly review new features to ensure you’re not missing out on any enhancements that could improve your workflow or compliance processes.

7. Accessing Research Tools

Integrated research tools can typically be accessed directly from within the CCH software interface. Look for a research or reference tab or section within your CCH product. From there, you can navigate to the specific type of information you need, whether it’s tax law summaries, regulatory updates, or interpretive guidance.

· Conducting Searches

The search functionality within CCH research tools is robust, allowing you to filter results by keyword, topic, jurisdiction, and document type, among other criteria.

When faced with a complex compliance question, begin by entering relevant search terms into the search bar. Utilise advanced search options to narrow down your results to the most pertinent documents.

· Utilising Filters and Advanced Search Options

To refine your search results further, take advantage of filters and advanced search options. These might include filtering by date to find the most recent updates, by jurisdiction to find location-specific information, or by document type (e.g., case law, IRS rulings, legislative updates) to target your search more precisely.

· Analysing Search Results

CCH research tools typically provide a summary or abstract for each document in the search results, helping you quickly determine its relevance to your query. Look for key indicators such as the document title, publication date, and source to assess the authority and timeliness of the information.

· Leveraging Document Features

When you access a document within CCH research tools, you’ll often find features designed to enhance your research experience. These might include:

- Annotations and Citations: Many documents include annotations or citations that can lead you to related content, providing a broader context or additional insights.

- Bookmarking and Note-Taking: Use built-in features to bookmark important documents and take notes directly within the software, keeping your research organised and accessible.

- Hyperlinked References: Documents often contain hyperlinks to referenced statutes, regulations, or other related documents, allowing you to explore topics in greater depth with ease.

To maximise the benefits of integrated research tools, incorporate them into your regular workflow. When encountering a new compliance issue or regulatory change, make it your first step to consult the CCH research tools for authoritative guidance. This ensures that your work is always informed by the most current and comprehensive information available.

8. Staying Current with Research Updates

CCH research tools are regularly updated to reflect the latest changes in tax laws and accounting standards. Enable notifications or alerts within the software to be informed of new updates, ensuring that you’re always working with the most recent information.

9. Embrace Automation for Routine Tasks

One of the most significant benefits of CCH products is their ability to automate routine tasks, from data entry to report generation. Identify repetitive tasks within your workflow that can be automated with CCH tools.

Setting up automation for these tasks can reduce manual errors, increase efficiency, and free up your time for more strategic activities.

10. Leverage Cloud-Based Features for Flexibility

Many CCH products offer cloud-based functionalities, allowing you to access critical data and tools from anywhere, at any time.

Make the most of these cloud features to enhance collaboration among your team, facilitate remote work, and ensure that your data is securely backed up and accessible when needed.

11. Implement Best Practises for Data Security

With the increasing reliance on digital tools, data security is paramount. Ensure that you’re following best practises for securing your CCH software and the sensitive data it contains. This includes using strong, unique passwords, enabling two-factor authentication, and regularly reviewing access controls and user permissions.

The Creative Networks Advantage:

Ready to transform your tax and accounting workflows with the power of Wolters Kluwer’s CCH products? Creative Networks is here to guide you through the process, ensuring that your practise not only meets but exceeds compliance requirements while optimising efficiency.

Our team of experts specialises in implementing, customising, and supporting CCH solutions, tailored specifically to your unique business needs.

From streamlining your tax preparation process to enhancing your financial reporting, we provide end-to-end support to ensure you’re getting the most out of your investment.

Take the Next Step: Visit Creative Networks or contact us directly to discover how our expertise can benefit your practise. Whether you’re looking to adopt CCH products for the first time or aiming to maximise your current setup, we’re here to help.